How To Benefit From Tax Deductions And Business Expenses Today!

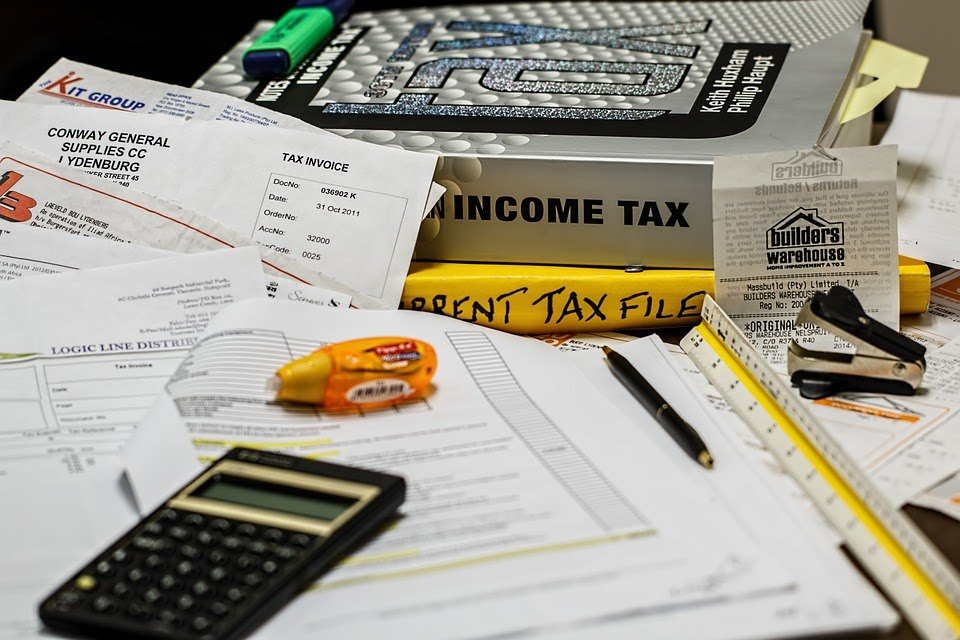

Every business has expenses, however, this article will focus on how one can benefit from tax deductions and business expenses. Anyone can benefit from any form of savings – especially if you are a small business or small start-up. We will be outlining some benefits that any business can take advantage of and how to make this possible.

Tax Deductions – The Expenses You Need To Claim

When many people hear the word ‘expenses’ it can often strike fear into their hearts. This is especially the case for entrepreneurs and CEOs who need to try to keep the cost of their business down to an absolute minimum so that they can try to maximize their profits. But are expenses really all that bad?

Well, in fact, they can be an entrepreneur’s secret little helper when it comes to paying tax. When your accountant figures out your final tax bill for the year, they will deduct all of your business expenses from the money you made.

You then only pay tax on the final amount once expenses have been taken off. So, the more expenses you have, the less tax you will end up paying.

Sounds good, right?

Here are some of the expenses you can use to reduce your tax bill.

Business Travel

Do you regularly have to travel for business meetings and conferences? If so, you should keep your travel receipts as these can be classified as business expenses. That includes your train or flight tickets and the cost of your accommodation. And not to mention expenses like the charter a private jet cost, if you decide to travel with a bit more style.

If you drive, you can’t claim the total amount of petrol for the trip, as you can’t prove that the journey was purely business. But you will be able to claim for a percentage of the overall cost of petrol – it’s a good idea to check with your accountant how much you can claim.

Office Supplies

Whenever you buy anything for your office, keep the receipt and put it towards your expenses. Ink and toner from 123inkjets, printing paper, office furniture, and any decor issues can all be claimed back in your taxes. Basically, no matter what you buy for your office, it can be claimed as a company expense!

Professional Subscriptions

Do you subscribe to professional magazine subscriptions, such as trade publications? If so, don’t forget to claim these. You also need to remember that any subscriptions for computer software and programs can also be claimed as professional subscriptions too.

When you #freelance, you get to be your own boss—as well as your own accountant, tax preparer, and bookkeeper. Try these tips to manage your money so you can focus on what you actually enjoy doing: growing your business! https://t.co/BskUEGaE8V #InDoersWeTrust pic.twitter.com/yabcen2pu3

— Fiverr (@fiverr) February 26, 2018

Financial Costs

Lots of entrepreneurs try to cut their costs by taking care of their accounts and taxes themselves. However, it really is worth hiring an accountant as they can save you money. Not only that, though, but you can claim their fees as business expenses!

Actually, anyone who does outsourcing work for your company can be considered a business expense. This is one reason why so many entrepreneurs like to bring interns and freelancers on board – they bring fantastic relief from taxes!

Marketing

There are a lot of costs that you might incur for your business marketing. For instance, paying for sponsored Facebook posts, buying video equipment, and printed media will quickly add up. Thankfully, though – you’ve guessed it – all of these expenses can be deducted from your taxes. So don’t forget the receipts and invoices!

As you can see, there are many ways you can reduce your annual tax bill. But you can’t claim an expense if you don’t have the invoice or receipt – so don’t forget to keep them somewhere safe!

My Final Thoughts On How To Benefit From Tax Deductions And Business Expenses

I hope you found some useful information in this article. Of course, always remember that you need to focus on your business by giving it your expertise. In this light, maybe you should outsource this aspect of the business so that you can effectively reap the full benefits of your tax deductions and business expenses by having a professional accountant do the job. It might result in yet more savings for your business. All the best.

Images courtesy of Pixabay, UnSplash, and Pexels.

Do you know that the more you use your brain, the better it is for you? AND, the more difficult it becomes to get ‘old’? Yup, the brain is really a ‘muscle’, and the more you ‘exercise’ it, the better and stronger it becomes. With that said, let’s see how we can make the brain better.

How about that second career? Ever thought about writing? Or even have someone write for you if you think this would be a better alternative? Well, how about creating your own website? Letting your voice be heard…without actually talking…but using words online. We all have a story within us…what’s yours?

The time is NOW, step out into the world of possibilities…do something different and discover new horizons. It is not difficult and certainly easy when you know the way to do it.

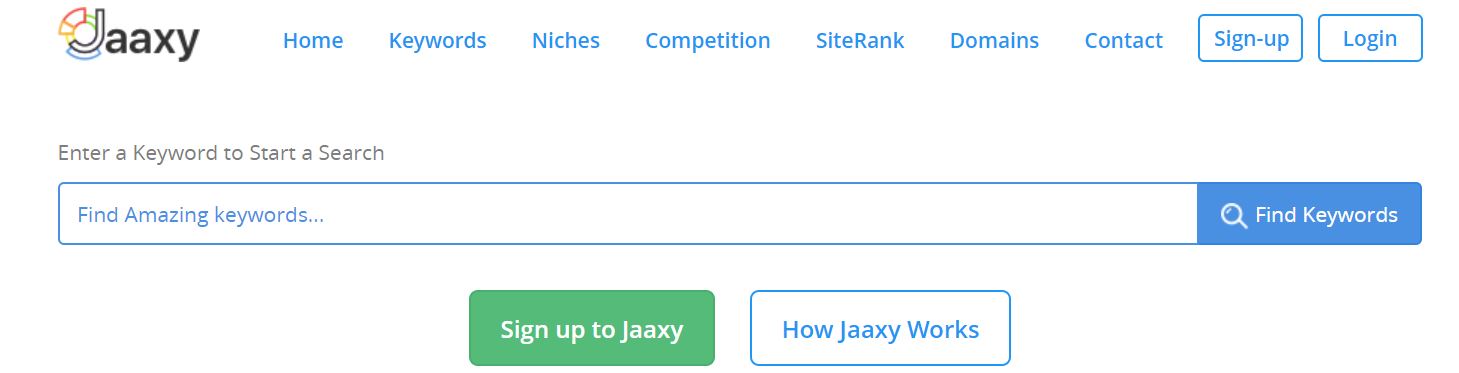

Let me introduce you to Wealthy Affiliate, the place where I learned how to create a website and ‘let my voice be known’. This is where I learned how to create my own blog and connect with people who helped me along the way.

Get your free hobby makeover guide I created to help you get started.

In it, I will tell you:

- how to create your first website and still have 25 FREE ones in addition

- choose a niche

- get a marketing strategy in place

- and of course, the best place to get started – for free – no credit card needed for the 7-day FREE trial membership.

When you learn how to create your own blog, you get to choose the things that you write about. You can also use the blog to make extra income.

Make Another Dream A Reality – Get Your FREE Hobby Makeover Guide TODAY – It is your motivation to make a new start in your life…no matter where you are – geographic location is NEVER a problem either, especially when you live the laptop lifestyle.

Photo by ThisIsEngineering from Pexels

Hello there, I am

Hello there, I am

6 thoughts to “How To Benefit From Tax Deductions And Business Expenses Today!”

Good record keeping is so important! It takes forever to go back and re-create it at tax time. Much easier to have a record-keeping system. This is good information! Perhaps a file in my computer for each category?

Hello Annie,

Thanks for visiting. Yes, good record keeping is a ‘must’ not just for personal but for business as well. Great idea about creating a file on your computer for each category! Actually, this is what I do and it works wonderfully. Thanks for the insight.

Michelle

Valuable information, Michelle. I believe in hiring a professional to handle all aspects of tax preparation. Excellent tips on the business deductions I had not thought of. Thank you.

Hello Sue,

Thanks for visiting. Yes, you are like me – I choose to hire the services of a professional tax preparer and let them do what they do best!

All the best.

Michelle

Michelle,

There are a lot of things that are tax deductible for a small business. A quick question for you. If you have just started up an online business, but it is not incorporated, are you still able to deduct your business expenses? The expenses that I am referring to are membership fees for training, hosting costs, pictures that have been purchase and other types of expenses.

Lisa

Hello Lisa,

Thanks for stopping by!

Yes, there are quite a few things that you can write off as tax deductions for your small business – just like the expenses you have outlined. Of course, I am not a CPA or accounting specialist, so please consult with one to be sure. Until you can change gears from sole/individual proprietor to an official incorporated business, you can still benefit from some of the tax write-offs for your small business. Much success.

Michelle